Protect Your Property.

Prove Your Claim.

Most homeowners expect insurance to come through after storm damage. But over 50% of claims get denied - not because the damage isn't real, but because the proof isn't there. Storm Proof documents your home before and after every weather event - giving you indisputable evidence when insurance tries to walk away.

The Storm Isn't Always What Costs You.

It's what happens after.

Every year, thousands of homeowners experience legitimate storm damage. Yet nearly 50% of claims get denied — not because the damage isn’t valid, but because insurance companies say there’s no proof when it occurred or blame a lack of maintenance.

50%

Claims Denied

Storm damage claims rejected due to lack of proof

$50,000

Average Loss

Out-of-pocket costs when insurance denies claims

1 in 2

Homeowners Affected

Face claim denials during their

homeownership

Without proper documentation, homeowners face an average of $50,000 in out-of-pocket repairs when claims get denied. That's where Storm Proof comes in.

You Can't Control the Weather.

You Can Control If You're Prepared.

Insurance companies count on homeowners being unprepared. Storm Proof arms you with professional documentation that that removes any doubt about when damaged happened or what the previous condition was, before a claim is filed.

While 1 in 2 unprotected homeowners face costly denials, our members get the coverage they deserve.

Professional 4K property documentation

High-resolution photos and detailed reports of every critical exterior component.

GPS-tagged, time-stamped inspection reports

Precise location and timing data that insurance companies cannot dispute.

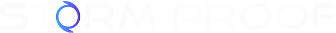

Preventive maintenance alerts

Early detection of issues before they become expensive problems.

Immediate post-storm re-inspections

Fast response within 72 hours to document any new damage

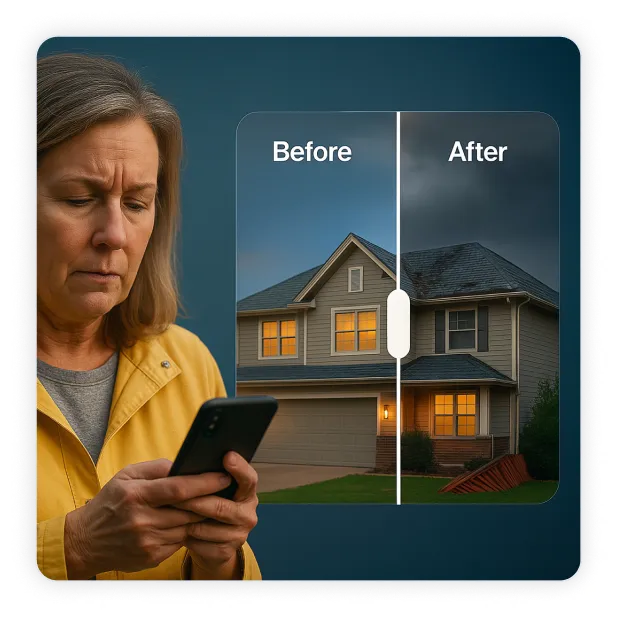

Secure digital storage & crisis locker access

Your documentation is safely stored and instantly accessible when needed

Direct evidence packages ready for insurers

Pre-formatted reports that meet insurance company requirements.

How Storm Proof Works

Paying attention to the details can save you thousands when it comes to your home and your wallet. With Storm Proof, you get:

Step 1

Pre-Storm Documentation

We capture comprehensive, time-stamped records of your roof and exterior with detailed photos and reports. This establishes your "proof of condition" before storms hit.

4K Ultra-HD Photography

GPS-Tagged Location Data

Detailed Condition Reports

Secure Cloud Storage

Step 2

Preventive Maintenance Alerts

We identify potential issues like cracked flashing, damaged shingles, or clogged gutters - small problems that could become expensive disasters.

Professional Inspection

Issue Prioritization

Avg. repair cost avoided, $3500-7000

Reduced chances of filing a claim

Step 3

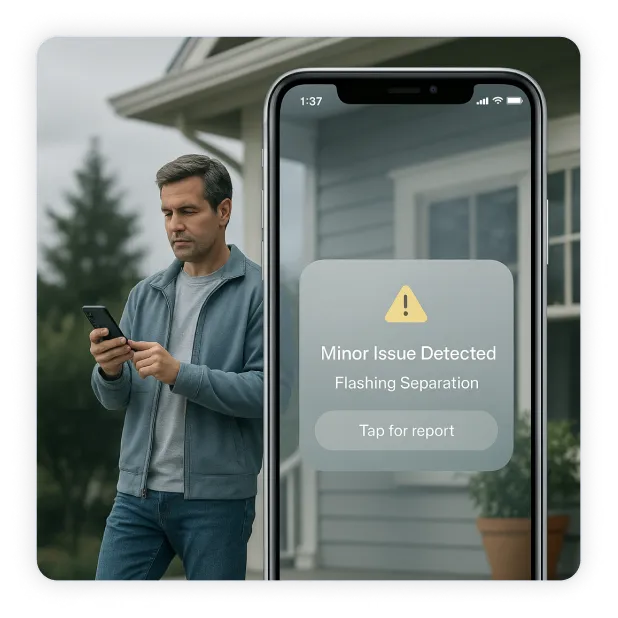

Post-Storm Season

After severe weather, we prioritize your home for detailed follow-up inspections, documenting any new damage with clear before-and-after comparisons.

Priority Scheduling

Before/After Comparisons

Damage Documentation

Insurance-Ready Reports

Step 4

Digital Storm Vault Access

Your complete documentation history, weather data, and insurance materials are stored securely in our cloud platform, organized and ready when needed.

24/7 Digital Access

Weather Data Reports

One-Click Report Generation

Encrypted Data Storage

Complete Protection. Zero Effort.

No need to remember dates, track storms, or climb roofs. Our automated system protects you seamlessly.

Meet the Founder & CEO

Built By An Insurance Insider Who Knows Their Playbook.

Storm Proof was created by a former insurance adjuster. After overseeing nearly $70 million in claimed damage, our founder saw firsthand how often homeowners were left footing the bill. The worst part? It wasn’t due to a lack of damage. It was due to a lack of proof and lack of maintenance.

Now, we use that experience help homeowners prevent claims and if they have to file a one, they are prepared with proof backed by experience.

"Insurance companies weren't winning because they were right - they were winning because homeowners had no evidence to support their claims."

Andre Kratt

Founder

Choose Your Protection Level

Affordable Protection for Every Homeowner

Each plan is designed to protect different areas of your property and shield you from various levels of potential damage and claim denials.

Essential Storm Proof

Roof Documentation

$29.99/mo

$419.88 Save $60

when billed annually

Pre-storm roof documentation

Post-storm roof documentation

Unlimited photo storage in the Storm Vault

Access to the Crisis Locker for claim ready document storage

Access Storm Season Preparation Kit

Common Coverage Gaps Checklist

Preventive Maintenance Checklist

Access to Home Defense Team (marketplace)

Custom 2-Year Storm Report

No contracts - cancel anytime

Storm Proof Plus

Roof + Guided Risk Review

$39.99/mo

$539.88 Save $60

when billed annually

Everything in Essential, plus:

Property Risk Discovery Call

Policy Coverage Snapshot

Personalized Maintenance Recommendation

Gutter & drainage spot-check

Tree & vegetation risk assessment

24/7 Severe Weather Impact Monitoring

No contracts - cancel anytime

Total Storm Proof

Full Exterior Documentation + Guided Risk Review

$49.99/mo

$659.88 Save $60

when billed annually

Everything in Plus, and:

FULL exterior documentation including; roof, roof components, siding and exterior walls, windows, doors, fences, pool enclosures etc.

Interior documentation guide

Meteorologist-backed storm reports

No contracts - cancel anytime

What Our Protected Homeowners Say

Real homeowners who made the smart choice to document their property before disaster struck.

"I had Andre come out to do an inspection on my property and I found him very helpful. He shared his knowledge and helped me through the entire process answering any questions I had. Highly recommend working with him."

Trent G

"Andre is knowledgeable and works hard for his clients. I have seen how he truly values his clients and strives to reach the most optimal outcome for their claims."

Erica B

"We never would've caught the flashing issue if it weren't for our Storm Proof inspection. The service paid for itself by preventing $4,800 in water damage repairs that insurance

wouldn't have covered anyway."

Amanda P

Frequently Asked Questions

Everything you need to know about Storm Proof and how we protect your home.

How often do I get inspections?

Lorem ipsum dolor sit amet, consectetur adipisicing elit. Autem dolore, alias, numquam enim ab voluptate id quam harum ducimus cupiditate similique quisquam et deserunt, recusandae.

What's included in a subscription?

Lorem ipsum dolor sit amet, consectetur adipisicing elit. Autem dolore, alias, numquam enim ab voluptate id quam harum ducimus cupiditate similique quisquam et deserunt, recusandae.

Do I need to be home for the inspection?

Lorem ipsum dolor sit amet, consectetur adipisicing elit. Autem dolore, alias, numquam enim ab voluptate id quam harum ducimus cupiditate similique quisquam et deserunt, recusandae.

Can this really help with insurance claims?

Lorem ipsum dolor sit amet, consectetur adipisicing elit. Autem dolore, alias, numquam enim ab voluptate id quam harum ducimus cupiditate similique quisquam et deserunt, recusandae.

Is this just for storm damage?

Lorem ipsum dolor sit amet, consectetur adipisicing elit. Autem dolore, alias, numquam enim ab voluptate id quam harum ducimus cupiditate similique quisquam et deserunt, recusandae.

How quickly can I get my first inspection?

Lorem ipsum dolor sit amet, consectetur adipisicing elit. Autem dolore, alias, numquam enim ab voluptate id quam harum ducimus cupiditate similique quisquam et deserunt, recusandae.

Why Choose Storm Proof?

93% claim approval rate

Built by insurance experts

Secure digital evidence vault

Still have questions?

Our expert team is here to help you understand how Storm Proof can protect your specific property.

Don’t Wait Until After The Storm

Storms are unpredictable. Insurance denials aren't.

Disaster can strike at any time. Right now, while your property is undamaged, is the perfect time to create the documentation that could save you tens of thousands later.

Copyright 2026. Storm Proof. All Rights Reserved.